Consumer spending growth is clearly slowing. This was predicted by me in September 2016 and reported in The Australian by Robert Gottliebsen on September 14 2016 (the following day in the print edition).

In this article, I analyze the recent evidence for the slowdown, identify the causes, discuss the changes in consumer behaviour, and present scenarios for future growth.

This issue is important for retailers and their suppliers, marketers of consumer goods and services, and for the federal government because GST paid by consumers affects government revenue.

The evidence

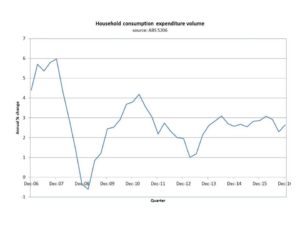

The broadest measure of consumer spending volume is household consumption expenditure published by the ABS (Chart 1). Spending growth has been slow since the GFC and clearly slowed in the second half of 2016. Growth in 2015 was 2.9% and dropped to 2.6% in 2016. This measure includes both discretionary and non-discretionary spending and the evidence is worse for discretionary spending. For example, sales of new vehicles to private buyers increased by 3.7% in 2015 but fell by 5.8% in 2016.

Chart 1

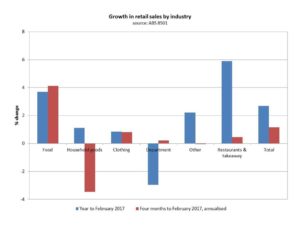

Retail sales dollar growth also slumped during 2016 and early 2017. In the year to June 2016, total retail sales growth was 3.0%, down from 5.2% in the year to June 2015. Sales growth has dropped further since: in the year to February 2017, sales growth was 2.7% and in the four months to February 2017, sales grew at an annualised rate of only 1.2% (based on seasonally adjusted data).

The evidence is clear: consumer spending growth is slowing.

The causes

There are several causes of this slowdown. Most obvious is weak income growth.

Employment growth was only 0.9% in the year to February 2017, compared with 2.1% in the year to 2016. Hourly wage growth was only 1.9% in the year to December 2016 (a record low) and the rate has slowed progressively from mid-2012 when the growth rate was 3.8%.

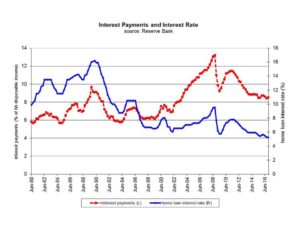

The income growth slowdown was offset for some time by the fall in interest rates (since 2011) a fall in the price of motor fuel (since 2014) and a fall in the price of electricity (since 2014 following the repeal of the carbon tax).

These offsets have now been exhausted and are now, or soon will be, subtracting from discretionary spending power. See Chart 2 for interest payments, which will rise as some mortgage interest rates are now increasing, and Chart 3 for motor fuel and electricity price inflation.

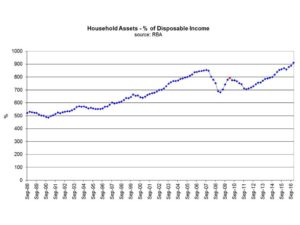

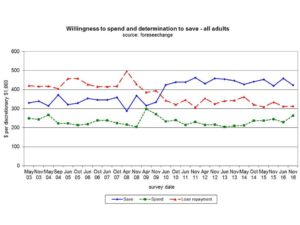

Other factors which have moderated the slowdown are the rise in household wealth (Chart 4) and an increase in consumer willingness to spend (Chart 5).

The household assets to income ratio has hit a record high in the December 2016 quarter and, given house price inflation, seems set to break the record again in early 2017. This is a boom that cannot continue for much longer, especially as interest rates are rising and prudential standards for lending to investors are tightening.

Willingness to spend has lifted since late 2014 and was quite high in late 2016. Without this rise, consumer spending growth would be even weaker.

Chart 2

Chart 3

Chart 4

Chart 5

Changed consumer behaviour

We can get some clues on how consumer behaviour has changed by analyzing retail sales by industry (Chart 6).

Food retail sales increased by 3.7% in the year to February 2017 and growth accelerated slightly over the four months to February 2017 (based on annualised growth of seasonally adjusted data).

Household goods growth went into recession over the past four months, clothing has been weak throughout, department stores recovered from recession to very slow growth, while growth slowed significantly in other retail (including pharmacy and newsagents) and especially in cafes, restaurants, and take away food.

Over the past four months, total retail dollars increased by $97 million. Food added $140 million, household goods subtracted $53 million, and the combined total of the other categories added just $11 million

Chart 6

This is all suggestive of an increase in the proportion of households hunkering down – spending more time at home and limiting non-essential spending.

Scenarios for the future

Clearly, without a significant increase in household income growth, consumer spending growth will remain anaemic. Could growth weaken? Yes, because it is being propped up by house price inflation, which must weaken soon, and higher willingness to spend which may not continue.

A reduction of house price inflation from 5% to zero would reduce retail sales growth by 1%, all other factors being equal. A fall in house prices could send retail sales into recession.

A fall in willingness to spend, from the recent level of $263 per discretionary $1,000, of $50 would reduce retail sales growth by 1%. This could happen if interest rates were to rise, or if the price of non-discretionary items rose significantly.

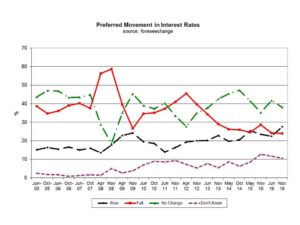

Interest rates loom as a problem because they are rising for standard variable mortgages but not for savings. While household debt is at a record high relative to household disposable income, deposits have also risen very significantly to $1 trillion and now more people prefer higher interest rates than prefer lower interest rates (Chart 7).

Chart 7

A fall in employment growth would also be a serious problem and this can’t be ruled out later this year, given the imminent closure of automotive manufacturing and the peaking of the housing construction boom. We really do need the federal government to deliver on its “jobs and growth” promise asap.

Implications

The slowdown in consumer spending growth will be painful for consumer marketers and for the federal government struggling with a budget deficit. There seems to be little prospect of improvement and a high likelihood of growth slowing even further.

The federal government needs to find a way to engender business willingness to invest in future growth and to employ more people in well paid jobs. Blaming the opposition and a recalcitrant Senate will not achieve the needed outcome.

Consumer marketers are going to have to get better at finding those consumers who are both willing and able to spend. Some 20% + of consumers fit this bill and are increasingly to be found amongst the over 45’s who hold most of the household wealth and are less exposed to the negative impact of rising interest rates.

Robert Gottliebsen drew extensively on this article in his column in The Australian on 7 April 2017 (it appeared a day earlier online).